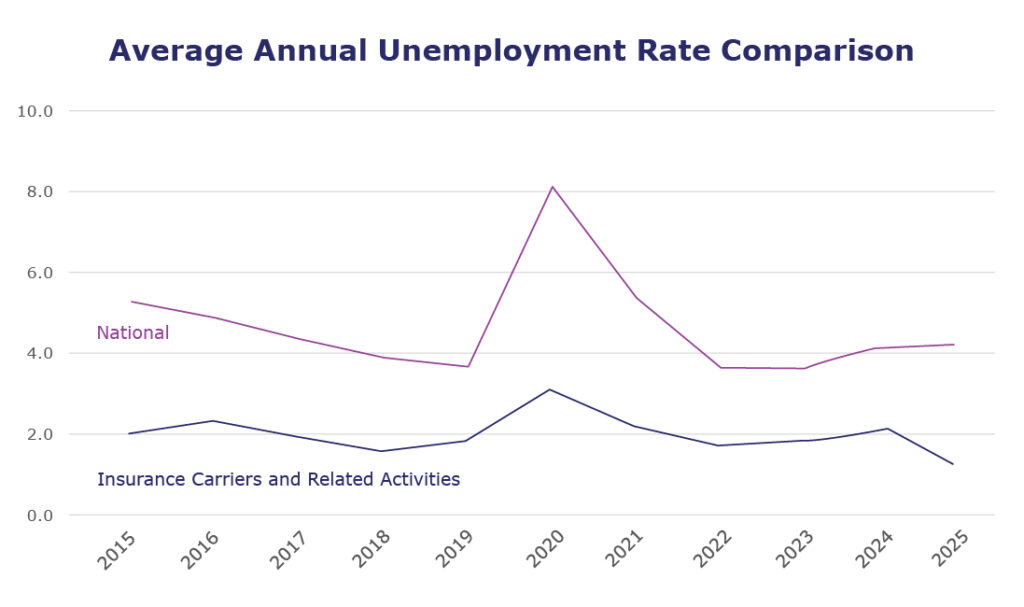

While the insurance industry saw a slight decrease in employment in June, the industry’s unemployment rate also dropped – hitting its lowest point since September 2023 at 1.3%. The dip of 1.6 points is the largest we’ve experienced since July 2023, when the unemployment rate then stayed below 2% for multiple months. However, similar to when we’ve seen spikes in unemployment, it’s too soon to determine if this will be a longer-term trend.

Within the larger finance and insurance sector, layoffs are down, dropping from a rate of 1% in April to 0.3% in May*. Job openings also saw a slight spike, increasing by about 90,000 positions to 374,000.

As the industry continues to navigate its talent strategies in the current climate, having insights to serve as a benchmark is essential. Our Q3 2025 Insurance Labor Market Study is now open for participation. Share your organization’s plans for the coming 12 months and receive a complimentary copy of the results. Complete the five-minute survey here: https://jcbsn.gr/2025q3-laborstudy.

| Unemployment for the insurance carriers and related activities sector decreased to 1.3% in June. | |

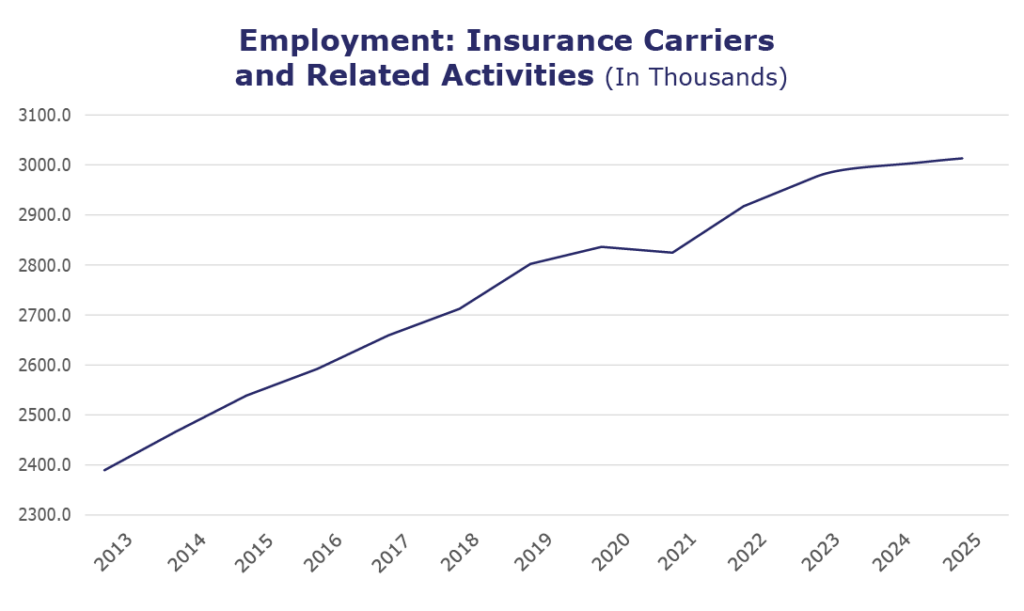

| The insurance carriers and related activities sector lost 1,600 jobs in June. | |

| At more than 3 million jobs, industry employment increased by approximately 22,400 jobs compared to June 2024. | |

|

The U.S. unemployment rate decreased to 4.1% in June and the overall economy added 147,000 jobs. |

- On a year-to-year basis, May* insurance industry employment saw job increases in claims (up 3.1%), agents/brokers (up 3.0%), title (up 1.3%), TPAs (up 1.2%), and property and casualty (up 1.0%). Meanwhile, jobs decreased in reinsurance (down 1.0%) and life/health (down 1.1%).

- On a year-to-year basis, May* saw weekly earnings increases in all categories: property and casualty (up 9.1%), agents/brokers (up 6.5%), claims (up 6.0%), TPAs (up 5.9%) and title (up 4.3%). **

Notes:

Adjusted employment numbers for May show the industry saw an increase of 1,700 jobs, compared to the previously reported decrease of 5,300 jobs. The BLS continues to revise numbers to be most accurate, which may contribute to inconsistencies, depending on when reports were pulled.

*The BLS Job Openings and Labor Turnover Survey report and reports on wages and employment for the industry category are only available for two months prior.

**The BLS has not reported on reinsurance and life/health insurance earnings since December 2024.

The source for the data represented in PULSE is the U.S. Bureau of Labor Statistics. Insurance data is derived from the insurance carriers and related activities sector.