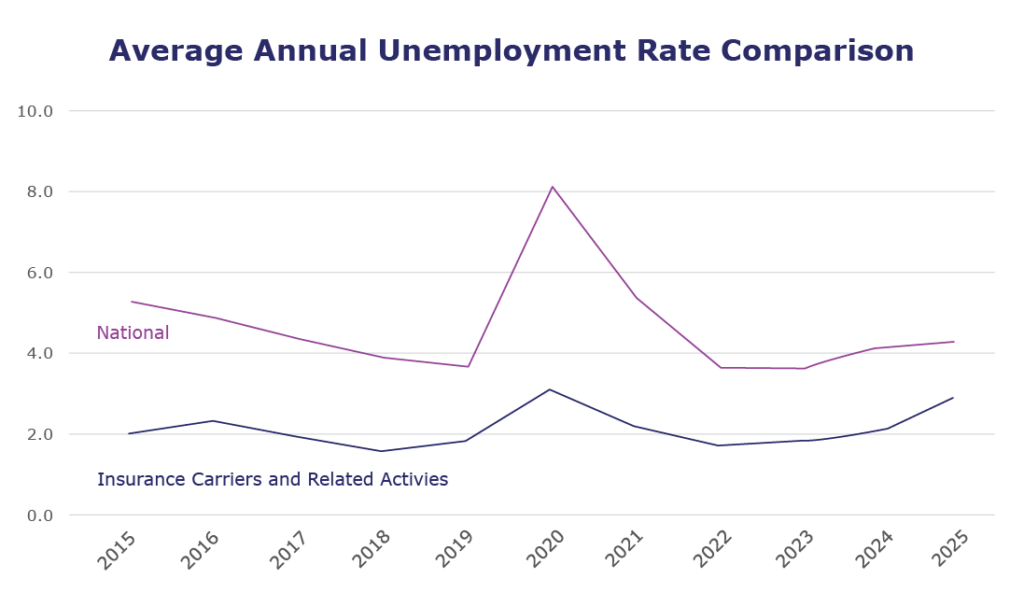

May saw insurance industry unemployment tick up slightly to 2.9%. At the same time, April numbers show a decrease in job openings for the larger finance and insurance industry, while layoff levels were the highest seen since November 2022. This slight change in numbers doesn’t indicate much at this point, but it’s something to keep an eye on in the coming months.

While the market remains relatively stable, but somewhat unpredictable, many insurers are focused on recruitment and retention. With 41% of high-performing individuals reporting lack of growth opportunities as a reason for seeking new employment, employee development is an effective retention tool. Read our recent blog post for effective development strategies that resonate in today’s environment.

| Unemployment for the insurance carriers and related activities sector increased to 2.9% in May. | |

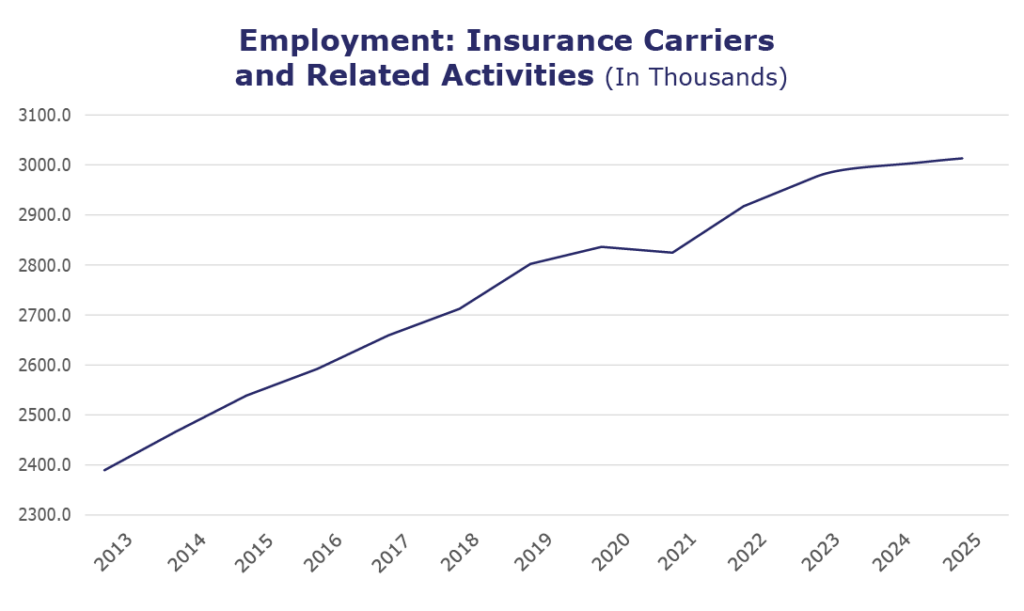

| The insurance carriers and related activities sector gained 5,300 jobs in May. | |

| At more than 3 million jobs, industry employment increased by approximately 35,400 jobs compared to May 2024. | |

|

The U.S. unemployment rate remained at 4.2% in May and the overall economy added 139,000 jobs. |

- On a year-to-year basis, April* insurance industry employment saw job increases in claims (up 5.2%), agents/brokers (up 3.1%), TPAs (up 1.2%), property and casualty (up 1.0%) and title (up 0.5%). Meanwhile, jobs decreased in life/health (down 0.9%) and reinsurance (down 1.0%).

- On a year-to-year basis, April* saw weekly earnings increases in property and casualty (up 8.6%), claims (up 7.5%), agents/brokers (up 6.5%), TPAs (up 5.1%) and title (up 3.6%). **

Notes:

Adjusted employment numbers for April show the industry saw an decrease of 4,800 jobs, compared to the previously reported decrease of 100 jobs. The BLS continues to revise numbers to be most accurate, which may contribute to inconsistencies, depending on when reports were pulled.

*The BLS Job Openings and Labor Turnover Survey report and reports on wages and employment for the industry category are only available for two months prior.

**The BLS has not reported on reinsurance and life/health insurance earnings since December 2024.

The source for the data represented in PULSE is the U.S. Bureau of Labor Statistics. Insurance data is derived from the insurance carriers and related activities sector.