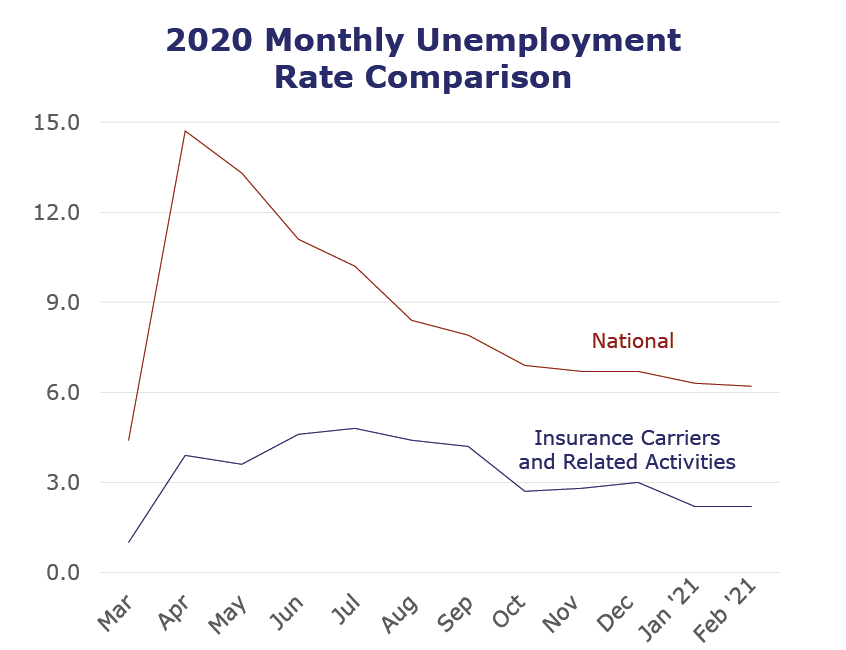

The insurance industry saw unemployment hold steady at 2.2% in February. However, the industry also experienced its second consecutive month of job losses since recovery from the COVID-19 pandemic began. The majority of losses appear to be in life/health and claims roles. In our Q1 2021 Insurance Labor Outlook Study, conducted in partnership with Aon plc, 14% of life/health insurers shared they were planning to decrease staff in the next 12 months. However, it’s likely this decline is temporary, as 43% of life/health insurers reported plans to increase staff in the same time period. Claims roles also saw a notable decrease, with a 9.5% decline in employment in January* 2021.

As companies enter a steadier state, we’re seeing increased activity and a focus on moving forward. Overall, 56% of insurers plan to increase staff in 2021. The greater U.S. economy is also seeing growth, with an increase of 379,000 positions in February and a slight drop in unemployment.

| Unemployment for the insurance carriers and related activities sector remained unchanged at 2.2% in February. | |

| The insurance carriers and related activities sector lost 2,900 jobs in February. | |

| The U.S. unemployment rate decreased to 6.2% in February with the addition of 379,000 jobs. | |

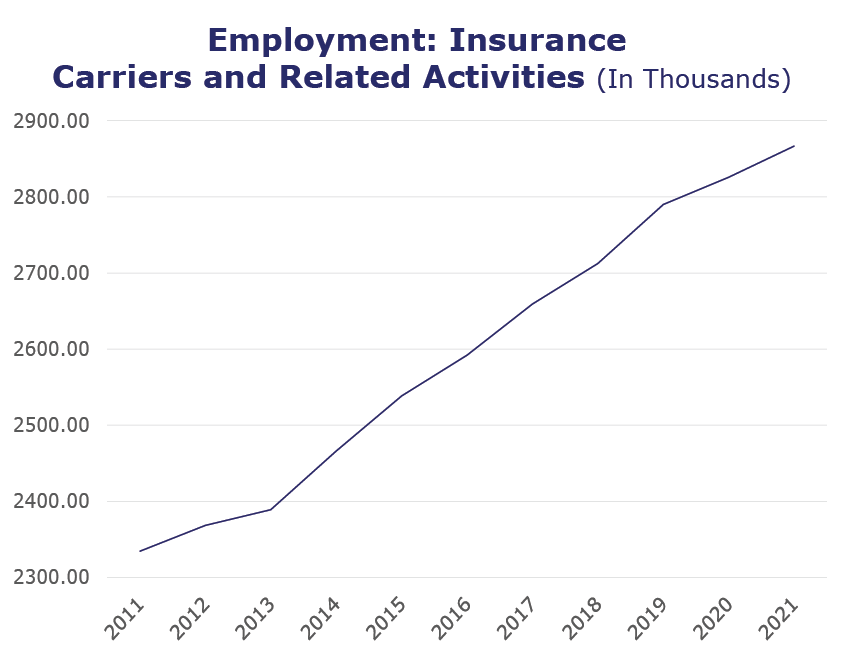

| At roughly 2.9 million jobs, industry employment increased by approximately 47,200 jobs compared to February 2020. |

INDUSTRY HIGHLIGHTS

- On a year-to-year basis, January* insurance industry employment saw job increases in title (up 8%), property and casualty (up 2.2%), agents/brokers (up 1.6%) and life/health (up 1.1%). Meanwhile, job decreases were seen for reinsurance (down 4.9%), TPAs (down 3.6%) and claims (down 1.1%).

- On a year-to-year basis, January* marked the seventh consecutive month of wage increases for reinsurance (up 21.5%), property and casualty (up 7.6%), title (up 4.7%), life/health (up 5.4%), agents/brokers (up 4.1%) and TPAs (up 0.8%). Meanwhile, wage decreases were seen for claims (down 3.4%).

BLS Reported Adjustments: Adjusted employment numbers for January show the industry saw a decrease of 8,900 jobs, compared to the previous reported decrease of 9,300 jobs.

*The BLS reports on wages and employment for the industry category are only available for two months prior.

The source for the data represented in PULSE is the U.S. Bureau of Labor Statistics. Insurance data is derived from the insurance carriers and related activities sector.