Industry Experiences Job Losses While Unemployment Drops One Full Point

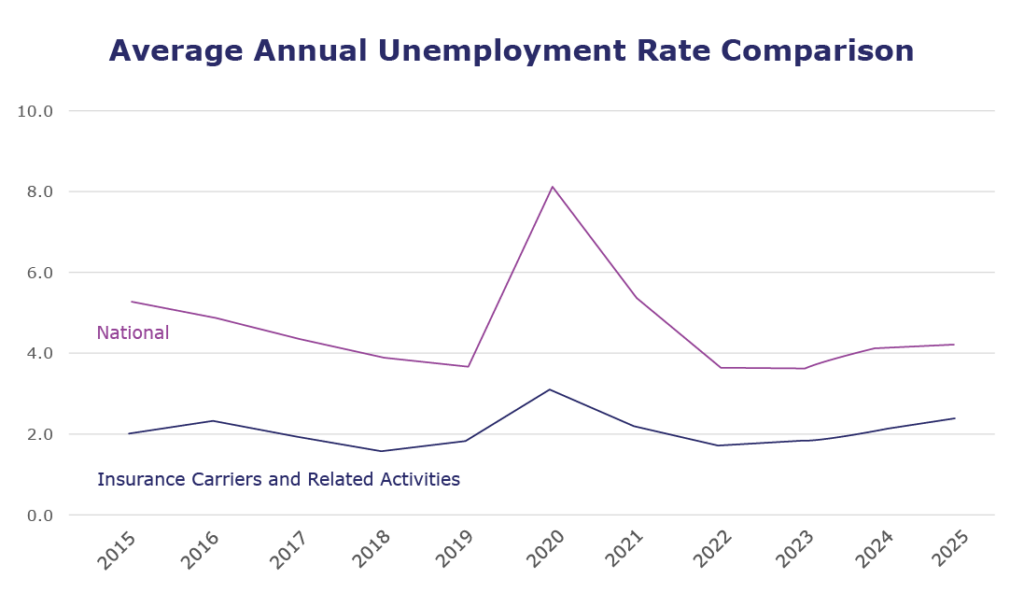

| Unemployment for the insurance carriers and related activities sector decreased to 1.3% in August. | |

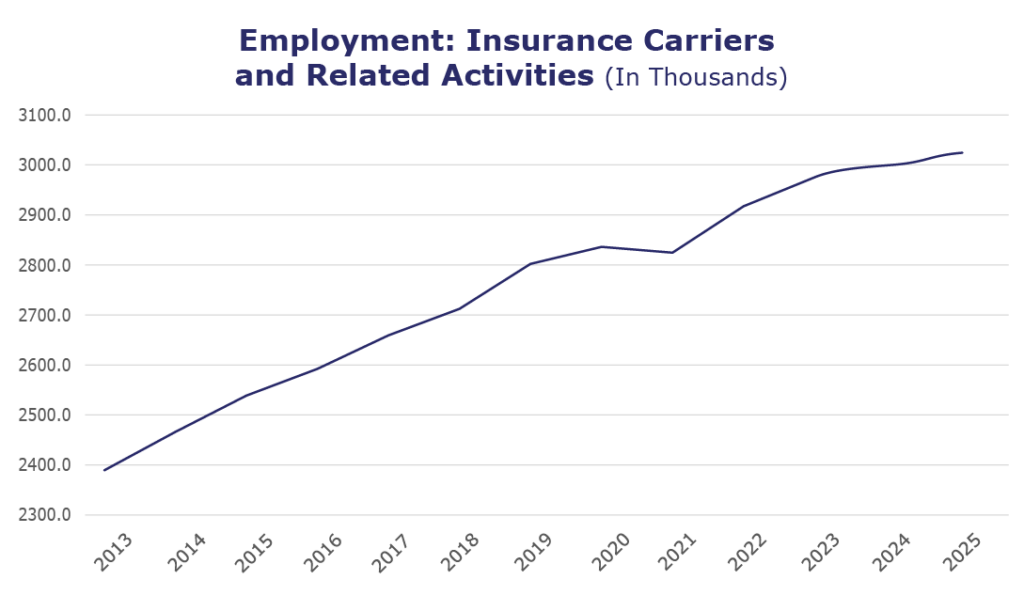

| The insurance carriers and related activities sector lost 5,500 jobs in August. | |

| At more than 3 million jobs, industry employment increased by approximately 12,400 jobs compared to August 2024. | |

|

The U.S. unemployment rate increased to 4.3% in August and the overall economy added 22,000 jobs. |

- On a year-to-year basis, July* insurance industry employment saw job increases in agents/brokers (up 2.3%), title (up 1.7%), property and casualty (up 1.6%) and TPAs (up 0.4%). Meanwhile, jobs decreased in life/health (down 2.0%), reinsurance (down 1.3%) and claims (down 0.5%).

- On a year-to-year basis, July* saw weekly earnings increases in all categories: property and casualty (up 9.0%), agents/brokers (up 6.9%), title (up 6.7%), TPAs (up 5.1%) and claims (up 3.5%). **

- Within the larger finance and insurance sector, job openings increased to 311,000 for July*.

- Both voluntary quits and retirements remained at stable levels for finance and insurance in July.

- The rate of hires within finance and insurance is tracking ahead for 2025 (at 2.2%) compared to 2024 (2.1%) and 2023 (1.9%).

Notes:

Adjusted employment numbers for July show the industry saw an increase of 7,900 jobs, compared to the previously reported decrease of 8,100 jobs. The BLS continues to revise numbers to be most accurate, which may contribute to inconsistencies, depending on when reports were pulled.

*The BLS Job Openings and Labor Turnover Survey report and reports on wages and employment for the industry category are only available for two months prior.

**The BLS has not reported on reinsurance and life/health insurance earnings since December 2024.

The source for the data represented in PULSE is the U.S. Bureau of Labor Statistics. Insurance data is derived from the insurance carriers and related activities sector.