While insurance unemployment continued to rise in June, the industry has added nearly 30,000 jobs since the start of the year. Within the larger finance and insurance category, job openings remain elevated amid a challenging recruiting climate. Additionally, pay continues to be relatively high for carriers although overall wage growth appears slightly slowed.

We’re continuing to see a realignment within the industry as insurers establish more finite parameters around long-term work environments and professionals evaluate their personal and professional needs. We invite carriers to share their expectations for the next 12 months by participating in our Q3 2022 Insurance Labor Market Study.

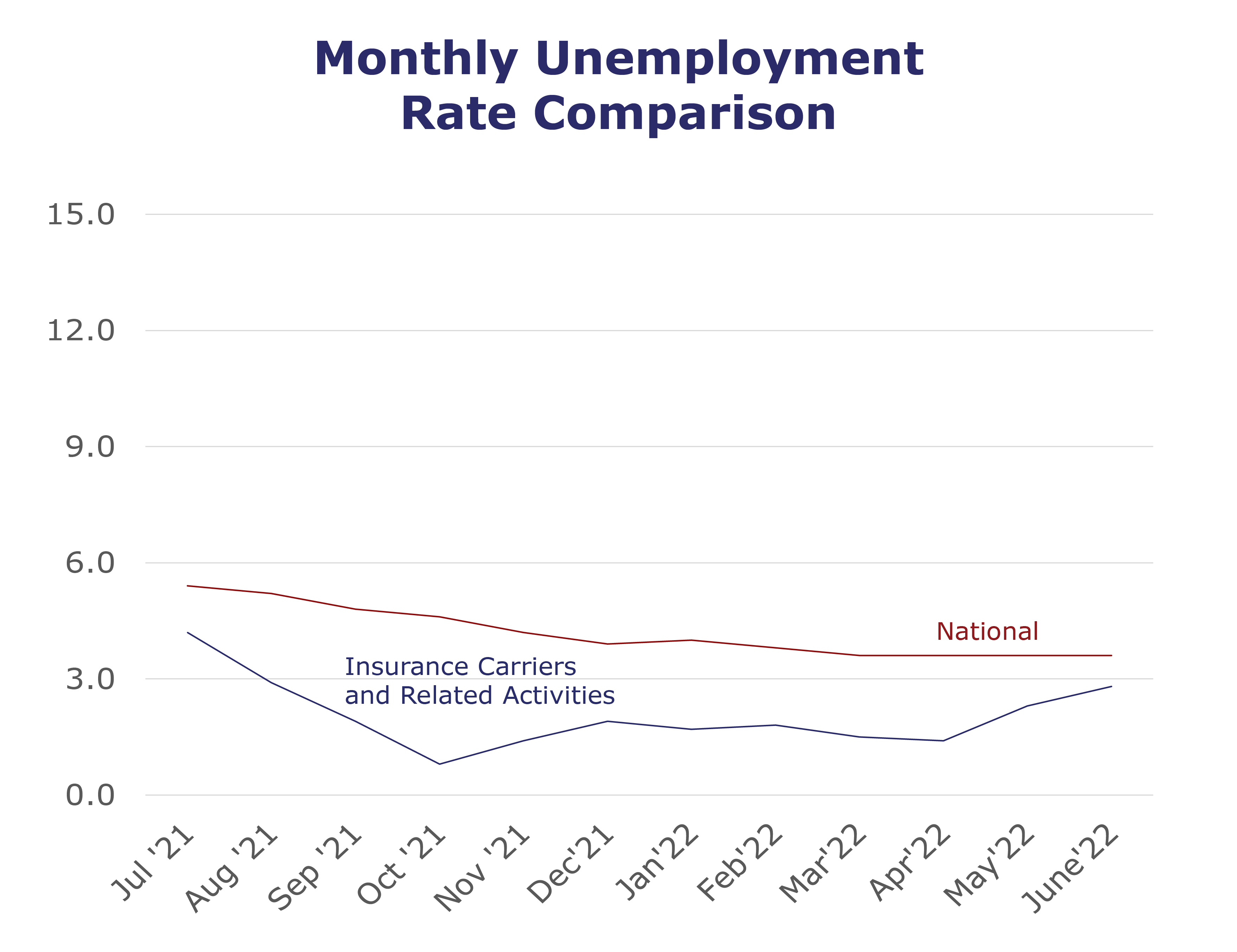

| Unemployment for the insurance carriers and related activities sector increased to 2.8% in June. | |

| The insurance carriers and related activities sector gained 7,200 jobs in June. | |

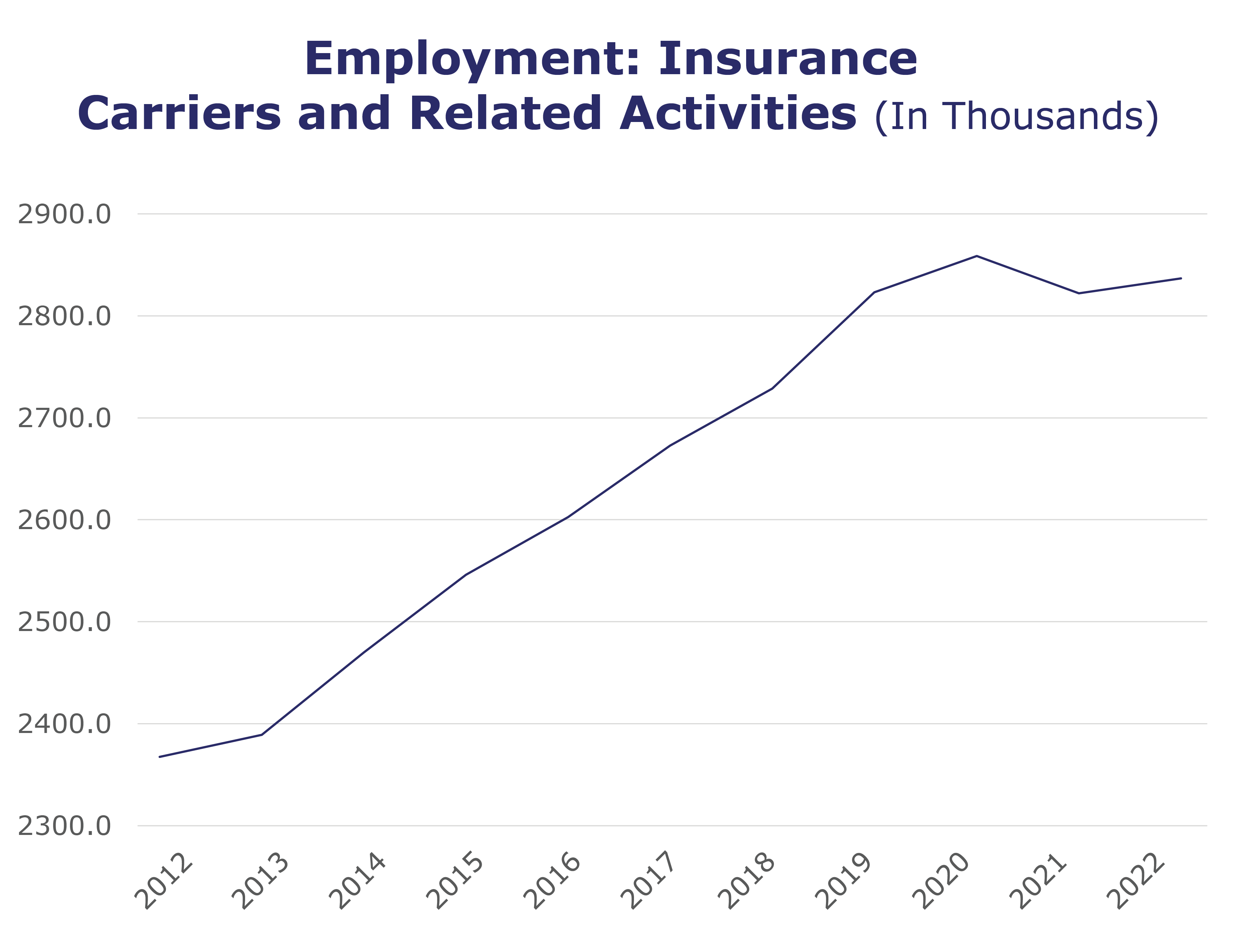

| At roughly 2.8 million jobs, industry employment increased by approximately 45,400 jobs compared to June 2021. | |

| The U.S. unemployment rate stayed at 3.6% in June and the overall economy added 372,000 jobs. |

INDUSTRY HIGHLIGHTS

- On a year-to-year basis, May* insurance industry employment saw job increases in agents/brokers (up 3.8%), title (up 2.4%), and TPAs (up 1.9%). Meanwhile, job decreases were seen in reinsurance (down 2.6%), property and casualty (down 0.3%), and life/health (down 0.2%). Claims jobs saw no change.

- On a year-to-year basis, May* saw weekly wage increases in claims (up 9.4%), property and casualty (up 4.9%), title (up 4.4%), life/health (up 4.2%), agents/brokers (up 3%), and TPAs (up 2.6%). Meanwhile, wages decreased in reinsurance (down 1.2%).

BLS Reported Adjustments: Adjusted employment numbers for May show the industry saw a decrease of 1,900 jobs, compared to the previously reported decrease of 6,100 jobs. The BLS continues to revise numbers to be most accurate, which may contribute to inconsistencies, depending on when reports were pulled.

*The BLS reports on wages and employment for the industry category are only available for two months prior.

The source for the data represented in PULSE is the U.S. Bureau of Labor Statistics. Insurance data is derived from the insurance carriers and related activities sector.